Surveys are an important part (perhaps even the most important part) of understanding your customers. A well-designed survey can provide a wealth of insight into how customers feel about your market, product, or service, allowing you to better solve customer problems, reduce the risk of them leaving your organization, and accelerate your company's growth.

When done well, a company can benefit from the results and insights gained. However, a survey is not much use if no one responds to it or the surveys are sent to the wrong people.

Although surveys are easy to create and distribute with the advanced software and programs available today, it can still be difficult to reach the entire target audience. Not only that, but it can be difficult to provide the right kind of encouragement to get the most accurate and honest responses possible.

Using the best distribution method for your customers, knowing the right time to survey them, and using thoughtful tactics to increase response rates directly impact the effectiveness of your survey.

In this article, we discuss the pros and cons of the most common methods for distributing customer experience surveys and review some tactics that can improve survey response rates.

Improve simplicity, efficiency and response rates

Why increasing survey response rates is often a challenge?

According to a chapter from the National Academies of Sciences, Engineering, and Medicine, "It is widely accepted that non-response is at least partially related to the perceived burden of participating in a survey." Without the right motivation, surveys can easily be ignored, and what motivates one group of people doesn't motivate another.

Survey participation is highly dependent on how easy and enjoyable the overall experience is, and is an important aspect of survey design. For this reason, customizing your survey distribution method to be as unobtrusive and enjoyable as possible for your target audience can play a big role in your success.

Survey distribution methods

As indicated above, different situations require different types of survey distribution. Although surveys can certainly be conducted in person or over the phone, for simplicity and efficiency, we'll look at survey distribution methods below.

In addition, they are the most cost-effective for most companies and the easiest to implement on a large scale.

Some unexpected benefits of online surveys are that companies have the ability to include videos, audio clips and links that may not be available with other types of surveys. In addition, customers have the option to complete surveys on their own time and at their own pace. They're also much less prone to social desirability – a type of response bias in which respondents tend to answer questions in a way that will be viewed positively by others.

So without further ado, let's take a look at using email, SMS, websites and URL links as a means to survey your customer base.

Email survey distribution

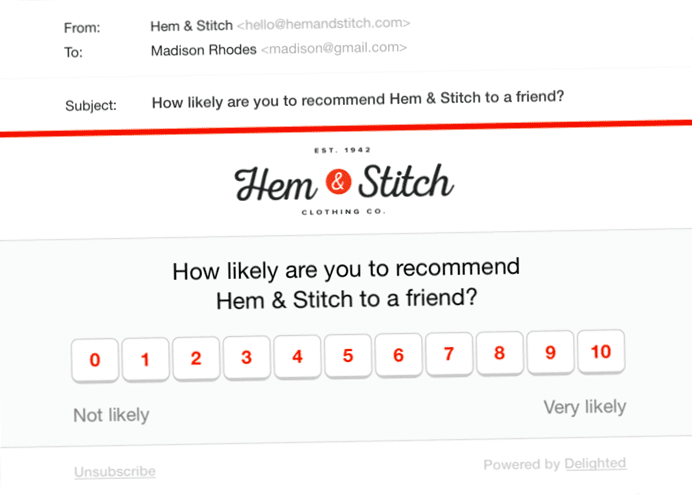

For email distribution, a basic method of distributing email surveys is to include hyperlinked text to your survey URL with the headline "Take this survey." to use.

You can also hyperlink an image to make your survey more clickable for your customer. This image can take a variety of forms, whether it's an attention-grabbing button or a background image that draws attention.

However, the least intrusive and most efficient method – assuming you're sending an HTML email – is to embed the first survey question directly into the body of the email. This often leads to a direct increase in the response rate for an email survey.

When to send surveys via email?

Many companies send email surveys after a customer has had time to try a product, or directly after a customer has used a service. However, it's also important to keep in mind that times of day can increase or decrease the chances of completing a survey. For example, Campaign Monitor found that most emails are opened during normal business hours of 9 a.m. to 5 p.m. In addition to specific times based on the time of purchase, your relationship with the customer/client and the type of service you provide may also determine when you should send a survey.

Pros

- Emails have the unique ability to create a certain level of expectation among respondents. Customers can see who is contacting them, why they are being contacted, and they know in advance if the email survey is incentivized.

- Emails can easily include additional content for your survey, e.g. Images or an introductory message for context.

- Email surveys often come with minimal cost, but with quick data collection from your desired audience.

- Email surveys can be triggered based on a recurring cadence or a specific interaction. Automated timing and personalization make it very easy for companies to send out email surveys.

Cons

- The absence of an interviewer generally means that more open-ended questions are harder to answer at the moment.

- It can be more difficult to reach populations that do not rely on email communications, such as. B. Older people or people who don't have access to the Internet.

- There is a possibility of survey fraud, and according to Explorable "there are individuals who answer online surveys solely to receive an incentive (usually in the form of money) after completing the survey, rather than with a desire to contribute to the study's progress."

Improve email survey response rates

The first step to improving email survey response is to increase your email open rate. An appealing subject line that includes an offer or raises expectations increases the likelihood that your customer will open the survey email. Personalization or incentives can go a long way toward drawing someone in. If you compare "Take our survey" to "Hi John, take a short survey and get 25% off," most people are more likely to feel attracted to the latter option.

Also, keep the survey short and sweet to increase the likelihood that your customer will not only begin the survey, but complete it in its entirety. Let them know how many questions there will be or how long it will take to complete the survey.

Best practices for email surveys

In general, standard survey best practices apply:

- Keep the questions clear and concise. Don't make things too complicated.

- Keep the design on brand without too many distractions in the background.

- Try to keep the survey as short as possible. The longer it is, the less likely it is to be completed. The same goes for the answer choices. Keep it short and sweet.

- Put the most important questions at the beginning, but don't be afraid to randomize the others if the order is not important.

SMS survey distribution

From the 1.1.By 2022, SMS is no longer a delighted sales channel. If you have any questions, please contact us. We're happy to help you explore other delivery channels or SMS options with our parent company, Qualtrics.

SMS surveys are a valuable way to get important feedback from your customers. With an SMS text survey, you can get instant feedback about an event or product from a customer while they are on the go.

You can either send a code with a survey invitation, or you can send your survey directly in text with single-choice, multiple-choice or free response options.

Similar to email surveys, surveys on SMS have higher response rates when the first question is embedded in the text and when incentives are provided.

When should surveys be distributed via SMS?

Surveys via SMS should be conducted after the service or product has been used so that customers can provide meaningful feedback.

Pros

- Survey data can be collected in real time based on location or time of day, so you can gauge sentiment in the moment.

- With the widespread use of cell phones, you have the ability to reach your target audience anytime, anywhere, especially younger demographics.

- SMS surveys are inexpensive and easy to use. Prices vary, but often SMS surveys are five to ten times cheaper than an in-person survey.

Disadvantages

- Probably the biggest limitation to using SMS surveys is obtaining the customer's consent to send an SMS survey in the first place. Also keep in mind that not everyone has a phone. So depending on your target audience, surveys via SMS may not be the right choice.

- Surveys on SMS are convenient, but the number of characters can limit the number of questions and messages you can send.

- There is a greater likelihood of errors or misleading responses due to typos or quick, ill-conceived answers.

Improving SMS survey response rates

As with email surveys, incentives for SMS surveys can go a long way toward motivating customers to participate.

By keeping your survey simple and direct, you increase the likelihood that it will be completed. People often don't want to spend a long time answering questions on their phone if it requires a lot of time or attention. As with any other tool, SMS surveys must be used selectively and strategically.

Best practices

More than 95% of text messages are opened and read. Therefore, to keep the recipient engaged, you should follow some best practices.

- Since text messages tend to be informal, keep the survey short and simple. Be clever, concise and as short as possible.

- Get permission before sending texts. Incentives can come into play here by offering prizes or deals to those who opt-in to receive text messages.

- Respond in real time with automated, yet personalized messages to keep your customers engaged and let them know their feedback is valued.

- Keep track of which messages and promotions are working and which are not.

- Choose a customer satisfaction survey platform that can deliver surveys quickly, across time zones, and that grows with your business.

Web Distribution of the sample survey

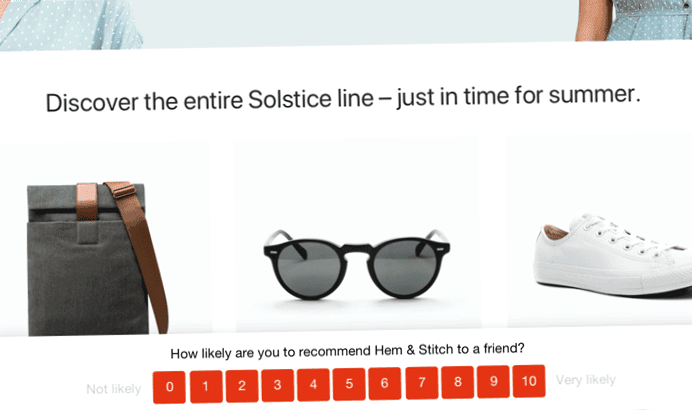

Web intercept surveys sound more complicated than they actually are. In reality, they are website pop-ups that ask a person on your website to answer a few short questions about the digital brand experience.

While web surveys in the past were perceived as annoying or distracting at best and a covert attempt to collect personal data at worst, they have become more sophisticated.

When to distribute surveys via the website?

When conducted at the right frequency on a website, these surveys allow your web audience to provide feedback based on the content consumed or actions taken.

Using cookies to track time spent on the site or other user actions can help determine the optimal time to deliver the pop-up survey.

Pros

- One of the biggest benefits of web surveys is real-time feedback that can be easily linked to a specific action or web page.

- Web section surveys, unlike SMS surveys, do not require an in-depth relationship with the respondent. They also allow for anonymity when responding to the survey.

- Surveys triggered immediately after using a web tool allow customers to provide more detailed feedback.

- A customer experience metric (NPS, CSAT, CES) can be created right after a customer interacts with your company.

Cons

- Because the information collected is often based on a specific experience, you don't get feedback on the other parts of the experience or the brand experience overall.

- Web Users may perceive these surveys as intrusive or not worth their time, which may result in them not responding.

Improve the response rate to website surveys

Determining your ideal audience is important to increase response rates. As mentioned earlier, use cookies to trigger surveys based on metrics such as time spent on the site, number of pages viewed or a site conversion. For this reason, you should keep your surveys short. Remember to capture what is happening to your client as it happens.

Best practices

Web query surveys have a good response rate for several reasons, largely due to some best practices:

- Keep it short. It's important to avoid jargon, keep wording simple, and ask as few questions as possible.

- Clean design and formatting. Leave some white space around the questions to ensure readability. The survey form should look inviting, but not too cluttered or distracting.

- Clear labeling. Questions should be related to the area they pertain to.

- Contextual timing and placement. Display the survey at a point within the user experience that allows you to collect the transactional feedback you need.

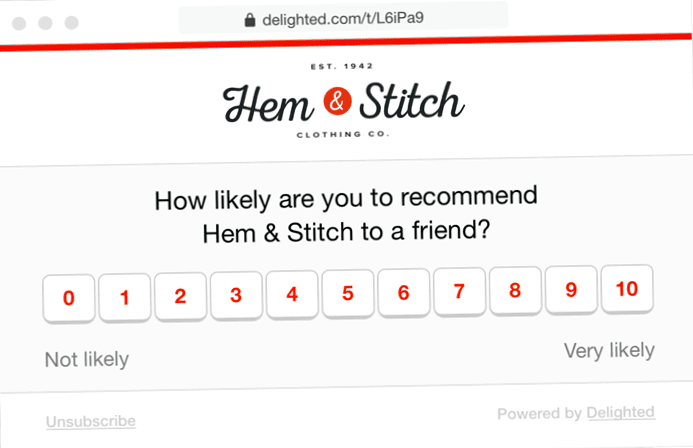

Distribution of the URL link to the survey

A link survey is an extremely versatile and efficient way to distribute your surveys. The beauty of using link surveys is that you can take the link anywhere, online and offline.

The survey link can be embedded in an article, shared on social media, or even printed out. Often, you can set the number of responses allowed per person or per link within a specific time frame to keep your feedback accurate.

When to distribute surveys using a link?

With link surveys, it's not so much a question of "when" rather than the "where". The timing of your link surveys depends more on the medium you are working with, the type of feedback you want to collect, and the audience you want to reach.

Some common use cases for link surveys include:

- Embedded in a live chat window. If you offer support via live chat, you can send a link to your customer satisfaction survey immediately after the chat ends.

- Embedded in an email signature. This would be a more passive request for feedback, as the survey is likely not the main focus of email communication. Customers could provide feedback each time they receive an email from you to assess the quality of the interaction.

- Printed on a receipt. Collect feedback after customers have purchased a product in the store.

If your company needs a versatile survey that can be placed on almost any online or offline platform, link surveys are a great choice.

Pros

- Link surveys are very versatile and can be used on many different online and offline platforms.

- Each time a new respondent accesses the link, you can design it to randomize the questions to avoid question selection bias.

Cons

- Depending on where you share the link, you may be less likely to get a response.

- Participants are less targeted – anyone can share the link, so you can't always be 100% sure who is responding.

- Link surveys tend to have lower response rates than other survey distribution methods that specialize in the channel they are used in. For example, a link to a survey in an email would get fewer responses than a survey embedded in an email.

Improve link survey response rates

Being strategic about where you use a link survey can make a difference in the number of responses you receive. By tracking which platforms get the most traffic and feedback, you can better determine when and where to share links.

Link surveys follow very similar best practices to the other distribution methods mentioned above. It's always a good idea to keep the survey short. If you find that a survey isn't getting much traction, review your strategy and test the survey across other interaction channels.

Best practices

Given the versatility of link surveys, it's important to follow some best practices for survey design to get the most out of them:

- Keep them relevant. Make sure you have determined what you want to achieve with the link survey. These goals will then determine who you survey and on what platforms.

- Pay attention to the scale of your questions and answers. Make sure they match the use case in which the link appears so your customers can respond honestly.

- Make sure the survey is short and sweet. You are always more likely to get a response if you respect your customers' time.

Conclusion

There is a lot to consider when choosing the main methods for distributing online surveys. While all of the methods we've outlined are time- and cost-efficient, there are still some important differences to keep in mind.

Email-based surveys make it easy to set expectations and incentivize a response. If you're more interested in a quick snapshot of information, SMS-based surveys are your golden ticket.

Website intercept surveys also allow you to solicit feedback directly online, without requiring a customer email or phone number. Finally, if you want to collect feedback across a variety of platforms, a link survey might be just the thing for your customer experience program.

To ensure you capture feedback from your entire audience, you'll likely need a combination of distribution methods and a customer feedback platform that allows you to monitor how often your customers receive each type of survey.

Try a survey distribution channel to see which one works best for your business with our experience management software, Delighted – your first 250 surveys are free.

The editorial team consists of external and internal Delighted thought leaders from various functions and industries. These experts provide educational content for companies looking to create high-impact, user-centric experiential programs using solution guides, personal narratives and how-to strategies.