Blog " BCG Matrix: What is it and how to apply it?

Do you know what a BCG matrix is for companies ? Don't worry, it's not a complicated mathematical process and you don't have to solve a puzzle.

It's a basic tool because it provides a framework for organizations to evaluate the success of each product.

It can also help companies identify a new product so that it can be introduced into the marketplace. It will help these organizations to use their material and human resources more intelligently.

Would you like to know how the BCG matrix can help you improve your company's profitability?? Then you should not miss this article:

What is the BCG matrix, and what is it used for??

A BCG matrix is a model for analyzing the products of a company. Based on this information, long-term strategic planning is carried out.

In this sense, the BCG matrix helps companies identify new growth opportunities and decide how to invest in the future.

The matrix not only provides an overview of product performance, but also helps identify what factors make a product successful or unsuccessful.

You can also compare products with each other here. It is a tool that allows you to discover new opportunities in your market and eliminate underperforming products, saving your company a lot of money in the long run.

What is the origin of the BCG matrix??

This model, also known as the Boston matrix or growth-share matrix, provides a strategy for analyzing products by growth and relative market share.

It has been used since 1968 to help companies figure out which products can best help them gain market share. This gives them a competitive advantage.

What are the components of the BCG matrix??

The BCG matrix is a simple framework that all companies can use to evaluate their products.

With this in mind, everyone has the opportunity to look at the matrix and understand which company's products are working best.

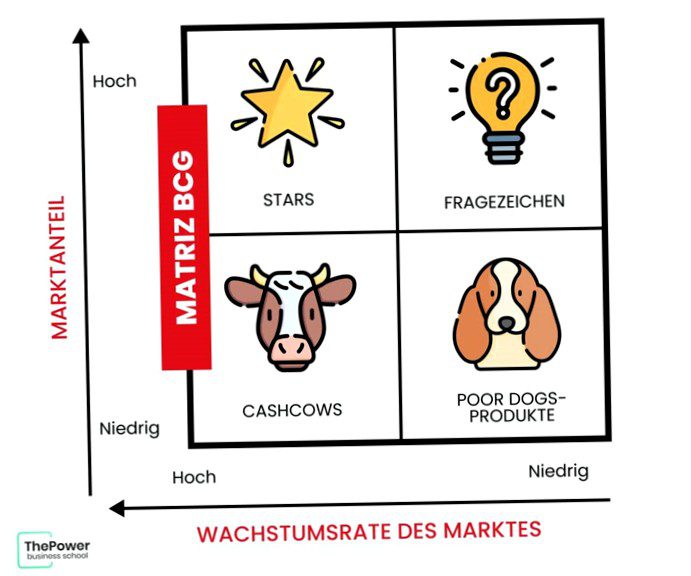

The matrix is divided into four quadrants based on market growth and relative market share:

1. Stars

In the BCG matrix of a company, star products are characterized by the fact that they have both high growth and high market share. They generate liquidity for companies and are in a dynamic environment so it is important to pay attention to them.

They require constant investment to consolidate their position in the market and become mature products that then become "cash cows".

In markets subject to constant technological innovation, they can become "poor dogs" , as they are resource intensive but can be driven out of the market by competitors.

2. Question mark

These are products that have high growth but low market share.

The question mark product is a high growth product that usually requires high financial investment but generates low revenue due to its low market share.

At this point in the BCG matrix, it is most beneficial to re-evaluate the strategy as it absorbs large amounts of resources and does not always perform positively.

These types of products or Strategic Business Units can evolve and become star products or, on the contrary, poor dogs.

3. Cashcows products

These products have a high market share and a low growth rate and can be considered products that are already consolidated in the sector.

Cashcows are a source of cash flow for the business as the investment required is usually very small.

For this reason, it is best to use the cash generated by the development of new star products, which can be converted into new cash cows in the future.

4. Poor Dogs Products

They have low market growth and market share and are not recommended for a company because they consume fixed costs and provide little or no value in return.

Since they can lead to negative results, their removal from the product portfolio should be considered.

These products can go through different phases and stages, and although a company will always try to keep them in the most favorable position, changes can still occur.

How to create a BCG matrix?

Although most companies have a variety of products on offer, some outperform others.

To analyze your business, you need data on the relative market share of your services or products and your growth rate.

When considering market growth, you need to objectively analyze your competitors and think about how they will grow over the next three years.

Porter's five forces are a useful framework for this type of analysis, but if your market is fragmented, you have the option of using absolute market share.

You can then draw a BCG matrix or find a BCG matrix template program on the Internet.

There are some free alternatives and others that you can either use on a subscription basis or that are offered in a graphics program.

BCG Matrix Template

This is a BCG matrix template that consists of four quadrants. It shows market share on the horizontal line (low on the left, high on the right) and growth rate on the vertical line.

The four quadrants are called question marks (top right), poor dogs (bottom right), cash cows (bottom left) and stars (top left),

Each of your products is placed in the appropriate box according to its position in terms of market share and growth.

The area where the dividing line is drawn between each quadrant depends in part on how the company compares to the competition. You will divide the quadrants as follows:

1. The quadrant of stars

The stars are the business units as well as the products that have the largest market share and make the most money.

Monopolies and products that enter the market first are also called stars.

Given their high growth rate, stars are characterized by a high consumption of cash, so the amount of incoming cash equals the amount of outgoing cash.

Stars can become cash cows if they maintain their success until the high-growth market slows down.

You can apply BCG's strategy of investing in stars to help grow the business.

2. Cashcows Quadrant

A cash cow is a market leader that usually generates more money than it consumes.

These are business units or products that have high market share but low growth prospects.

Cash cows provide the money needed to turn a question mark into a market leader. They are able to fund research and development, pay off corporate debt, and pay dividends to shareholders.

Invest in cash cows to maintain current productivity levels, or passively benefit from profits.

3. Poor Dogs Quadrant

Poor dogs are products or units with low market share and low growth rates. In addition, they are in equilibrium, d. h. they do not earn or consume too much money.

Poor dogs can be considered a money trap because companies have invested money in them, even though they typically yield almost nothing.

These businesses are prime candidates for divestment.

4. Question Mark Quadrant

These are the parts of a company that have high growth prospects but low market share. They tend to consume little money but contribute little in return.

Question marks cause companies to lose money, but because these businesses are growing rapidly, they have the potential to become stars in a high growth market.

Companies are advised to invest in question marks if the products have growth potential or, if not, not to sell them.

Use the BCG matrix to develop strategies

Once you know where each product stands, you can objectively evaluate it and develop a BCG strategy for the future of your business.

The BCG model helps identify products that need to be prioritized and those that need to be phased out altogether.

1. Alternatives for BCG Matrix Strategies

Using these four alternatives, you can create BCG matrix strategies:

- Increase your investment in stars and question marks if you want to focus on innovation. You have the opportunity to turn a question mark into a star and then into a cash cow by investing more in it.

- If you don't have the ability to invest more in a product, you can leave it in the same quadrant and let it fend for itself. The cash cow has the advantage of being an established product that requires less effort to maintain.

- It lowers your investment and gets the maximum cash flow out of a product, increasing its overall profitability. This is perhaps the most convenient strategy for cash cows.

- Part with the money you invested in a product and put it elsewhere, which is a good strategy for poor dogs.

Because consumer preferences are constantly changing, it's impossible to predict how a product will perform over the long term.

For these reasons, you need to regularly review and update your BCG analysis matrix, taking into account when market conditions change.

One example is that a product that was a question mark can quickly become a dog. You must be ready to leave the market if the stakes are too high.

By using the BCG matrix model, the goal is not to succeed in one particular area, but to create a diversified portfolio.

To do this, you need to have products in each quadrant of your BCG matrix to maintain a healthy cash flow and offer products to secure the future of the business.