The renowned and notorious shortseller Hindenburg Research has published a new short report. The goal: Block. It criticizes the company at length, and the stock collapses 20% as a result, after already trading well below all-time highs.

In the meantime there is also a counterstatement from Block, the course has recovered at least slightly. I look at what is behind the accusations and how I deal with them as a shareholder.

What does Block do?

Block (formerly Square) essentially consists of two business models: A payment processing platform (hardware and software) and the cash app. The payment platform is used online and offline by companies to process payments, the cash app mainly by private individuals – to send money, pay for things, or invest.

In the block stock analysis I looked at the stock. I invested after the initial price drop because I find the vision and ecosystem exciting, growth was high, and profitability was foreseeable. After that, the macroeconomic situation has worsened, the share price has fallen further. Now the Short Report is sharpening the picture.

The mechanics behind shortseller reports

Some investment firms are focusing on short-selling. They are betting on falling prices of what they see as overvalued companies. Sometimes these are right, as with Wirecard, sometimes these are wrong.

They are also subject to a conflict of interest: they go short, publish their research, and the stock falls, making them money directly.

Almost every time we see the same pattern: after publication, the company denies everything, looks into legal action and points out the conflict of interest. Sometimes other short-sellers join in, who then also take a closer look and accusations intensify. Sometimes companies manage to refute the allegations.

Hindenburg Research made the allegations on 23. March 2023 published. On the same day Block denied everything as described. On 30. March 2023 there was also a substantive response to shareholder questions.

Hindenburg Research allegations

At its core, Hindenburg says Block offers no special technology, but allows fraud, avoids regulation, and sells credit and fees as revolutionary, skewing metrics toward shareholders. Partners, employees and industry experts were interviewed for the report.

Our 2-year investigation has concluded that Block has systematically taken advantage of the demographics it claims to be helping. The “magic” behind Block’s business has not been disruptive innovation, but rather the company’s willingness to facilitate fraud against consumers and the government, avoid regulation, dress up predatory loans and fees as revolutionary technology, and mislead investors with inflated metrics.

#1 There are too many accounts being accounted for

Former employees report having to close 40-75% of accounts they reviewed (because fraud or fake). That’s mainly because Block is targeting an “underbanked segment” (i.e. a target group that has hardly been in the banking system before): Criminals (see allegation #2).

They even signed themselves up as Donald Trump and got the card to do so, with the fake name.

My guess: Sounds like a lot, but the question is how many even end up in a review.

#2 The cash app is used by many criminals

CEO Jack Dorsey is proud that the cash app is mentioned in many songs. In the process, Hindenburg points out – and has put together a curious video – that this is the case in many rap songs, where it is reported to have paid for a contract killing with the cash app.

“I paid them hitters through Cash App”

There would also be a disproportionate number of cases where covid assistance and unemployment benefits were improperly paid through the cash app.

#3 Block is charging more fees than allowed by law

A third of the cash app’s revenue could be overcharging because you’re using corporate construction to get around a law that’s supposed to cap fees charged by big banks. Block does not count as such.

Congress passed a law that legally caps “interchange fees” charged by large banks that have over $10 billion in assets. Despite having $31 billion in assets, Block avoids these regulations by routing payments through a small bank and gouging merchants with elevated fees.Block includes only a single vague reference in its filings acknowledging it earns revenue from “interchange fees”. It has never revealed the full economics of this category, yet roughly one-third of Cash App’s revenue came from this opaque source, according to a 2022 Credit Suisse research report.

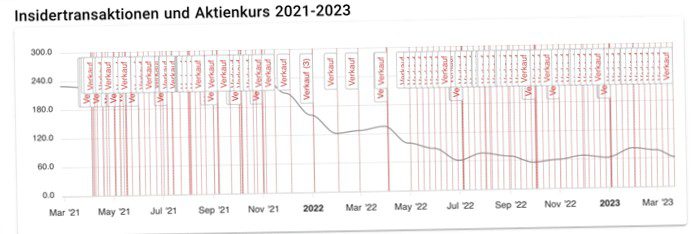

#4 Insider sales at their peak

Stock rose 639% in 18 months during the pandemic. Then the two co-founders together sold over 1 billion. Dollars of its stock, other executives sold as well.

Empirically, however, insider sales are not that significant. It’s normal to sell when most of your salary is stock. Still, of course, this smacks of blandness. In fact, Block is only seeing insider sales and that is virtually independent of the share price performance.

#5 Afterpay acquisition flops

Block’s acquisition of Afterpay has been criticized: It had cost 29 bn. dollars, but relied on attracting non-creditworthy customers. The business model still burns too much money today.

Block’s $29 billion deal to acquire ‘buy now pay later’ (BNPL) service Afterpay closed in January 2022. Afterpay has been celebrated by Block as a major financial innovation, allowing users to buy things like a pair of shoes or a t-shirt and pay over time, only incurring massive fees if subsequent payments are late.Afterpay was designed in a way that avoided responsible lending rules in its native Australia, extending a form of credit to users without income verification or credit checks. The service does not technically charge “interest”, but late fees can reach APR equivalents as high as 289%.The acquisition is flopping. In 2022, the year Afterpay was acquired, the pro forma combined entity lost $357 million, accelerating from pro forma 2021 losses of $184 million.

My assessment: This may all be true and I have also criticized this in my analysis. However, as I explained at the time, the actual purchase price was only 14 billion. Dollar, since it was paid with own and fallen shares until payment. The fact that a loss was made is not significant on its own, especially for a growth company.

#6 Technology is just standard

Hindenburg pokes a little fun at Block’s use of strong adjectives about its own technology being “magical” or “groundbreaking”. It sees in it rather a standard technology.

Block regularly hypes other mundane or predatory sources of revenue as technological breakthroughs. Roughly 31% of Cash App’s revenue comes from “instant deposit” which Block says it pioneered and works as if by “magic”. Every other major competitor we checked provides a similar service at comparable or better rates.

The fact that the technology is not as groundbreaking as it is described is also of little relevance to me. It is marketing. I already wrote about this in the analysis:

Square has its own technologies in each area. Hard to judge how much these are really better than alternatives, e.g. in payment systems or the sending of money. I see payment increasingly as an interchangeable commodity, as described in the PayPal analysis. Square is nevertheless technologically well positioned.

#7 Valuation is too high

On the one hand, valuation is still quite high, on the other hand, competition is increasing. Both were also visible before: Block never really looked favorable and the payment market is also getting growth from the big tech companies. The latter was also my criticism of PayPal.

Hindenburg now gives some fundamental facts and valuation metrics, sees 65 – 75% downside risk:

On a purely fundamental basis, even before factoring in the findings of our investigation, we see downside of between 65% to 75% in Block shares. Block reported a 1% year over year revenue decline and a GAAP loss of $540.7 million in 2022. Analysts have future expectations of GAAP unprofitability and the company has warned it may not be profitable.

There is talk of a 1% decline in revenue. This is factually correct, but not meaningful. Revenue is heavily driven by bitcoin trading activity, which barely brings margin. Gross profit better reflects operations and has increased over 30%. The question is, which facts you want to show.

Despite this, Block is valued like a profitable growth company at (i) an EV/EBITDA multiple of 60x; (ii) a forward 2023 ” adjusted Bei “adjusted”” If a measure calculated according to standard guidelines (GAAP) is adjusted for special effects, it becomes a “non-GAAP” measure Key figure. These special effects can be share-based payments, restructuring costs or currency fluctuations. You can make a better comparison, but. More ” earnings multiple of 41x; and (iii) a price to tangible book ratio of 13.1x, all wildly out of line with fintech peers.

I’m almost still surprised that Hindenburg refers to the adjusted expected P/E ratio – I find that too optimistic myself. Whether a book value makes sense for a payment company, I also doubt strongly. I also don’t understand the comparisons to Lemonade or Upstart, which have fairly different business models based on book value.

My assessment: In any case, the company is expensive, also according to other metrics. But gross profit also grows at 35 – 40%, over the last three years at 47. If growth continues and profitability increases, valuation levels could normalize. I’ll look at the valuation again in a moment.

Statement from Block

In the first reaction everything was blocked: Hindenburg is known for such attacks. These should scare off investors. They are tightly regulated and will not be distracted by it.

A week later there were substantive answers to some of the accusations.

If you’re already a member, you can log in here:

The content does not constitute investment advice or a recommendation to buy, but only reflects my personal opinion. Every investment is risky. Before every investment you should check chances and risks yourself.